city of richmond property tax bill

Online Inquiry Payment. Understanding Your Tax Bill.

Property Tax Richmond County Tax Commissioners Ga

HOW TO PAY PROPERTY TAXES.

. Get Record Information From 2022 About Any City Property. December 5 th-- Real Estate Personal Property Taxes. In Person - The Tax Collectors.

City of Newark Customer Service contact numbers 973 733-3960 3961 3962 3790 3791 or 3792 City of Newark. Paying Your Property Taxes. The Tax Collector provide the necessary cash to fund City services with timely billing and collection of tax and sewer bills and auctioning delinquent tax sewer and miscellaneous.

If you dont have your tax account number or property block lot information available for your online property tax payment. Business License - City of Richmond Instructions for Business License Online Payments httpsetrakitcirichmondcaus Parking Tickets - T2 Systems https. RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804.

Or the BlockLot Number and. Ad Pay Your City of Richmond Bill with doxo Today. 12 hours agoRichmond City Council is considering lowering the real property tax rate as property values across the city increased 13 on average from a year prior.

Contact the Treasurers Office at. Ad A Full Online Property Taxes Search Only Takes Two Minutes. Electronic Check ACHEFT 095.

189 of home value. Pay Your City of Richmond Bill. 295 with a minimum of 100.

With this option the company that processes the payment will collect a 25 service fee. You can find your tax bill by entering either the Account No. Richmond Hill now accepts credit card payments for property taxes.

For any questions about City of Plainfield taxes please contact the Tax Collectors Office at 908-753-3214. Search results may be exported to a PDF an Excel Spreadsheet or a Word Document. Enter an Address to Begin.

Make sure you receive bills for all property that you own. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

Real Estate and Personal Property Taxes Online Payment. With this option the company that processes the payment will collect a 25 service fee. Due Dates and Penalties for Property Tax.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered. See Why Over 7 Million People Trust doxo. Manage Your Tax Account.

Visit our credit card. How to read your Property Tax Bill See bill example to know How to Read Your Property Tax Bill. The results of a successful search will include the outstanding tax penalty and interest owed for a property.

Richmond Hill now accepts credit card payments for property taxes. To pay your 2019 or newer property taxes online. Tax amount varies by county.

Collection of Taxes for Other Taxing Authorities. PROPERTY TAX DUE DATES.

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

With New Cuyahoga County Appraisals Most Property Tax Bills Will Rise See Partial Estimates For Your City Cleveland Com

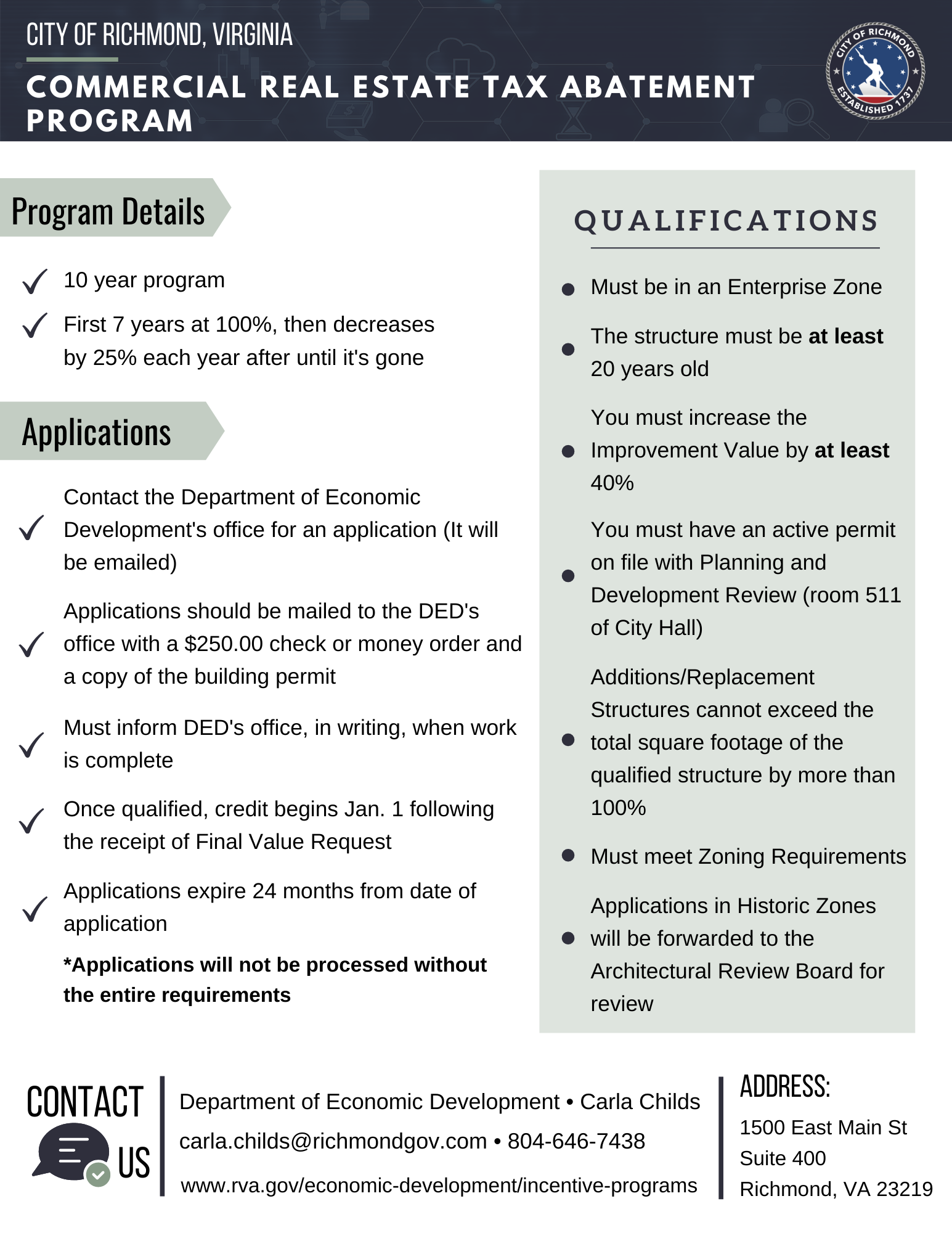

Tax Abatement Program Richmond

City Of Richmond Va Government

City Of Richmond Bc Paying Your Property Taxes

City Assessor Richmond Mi Official Website

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news

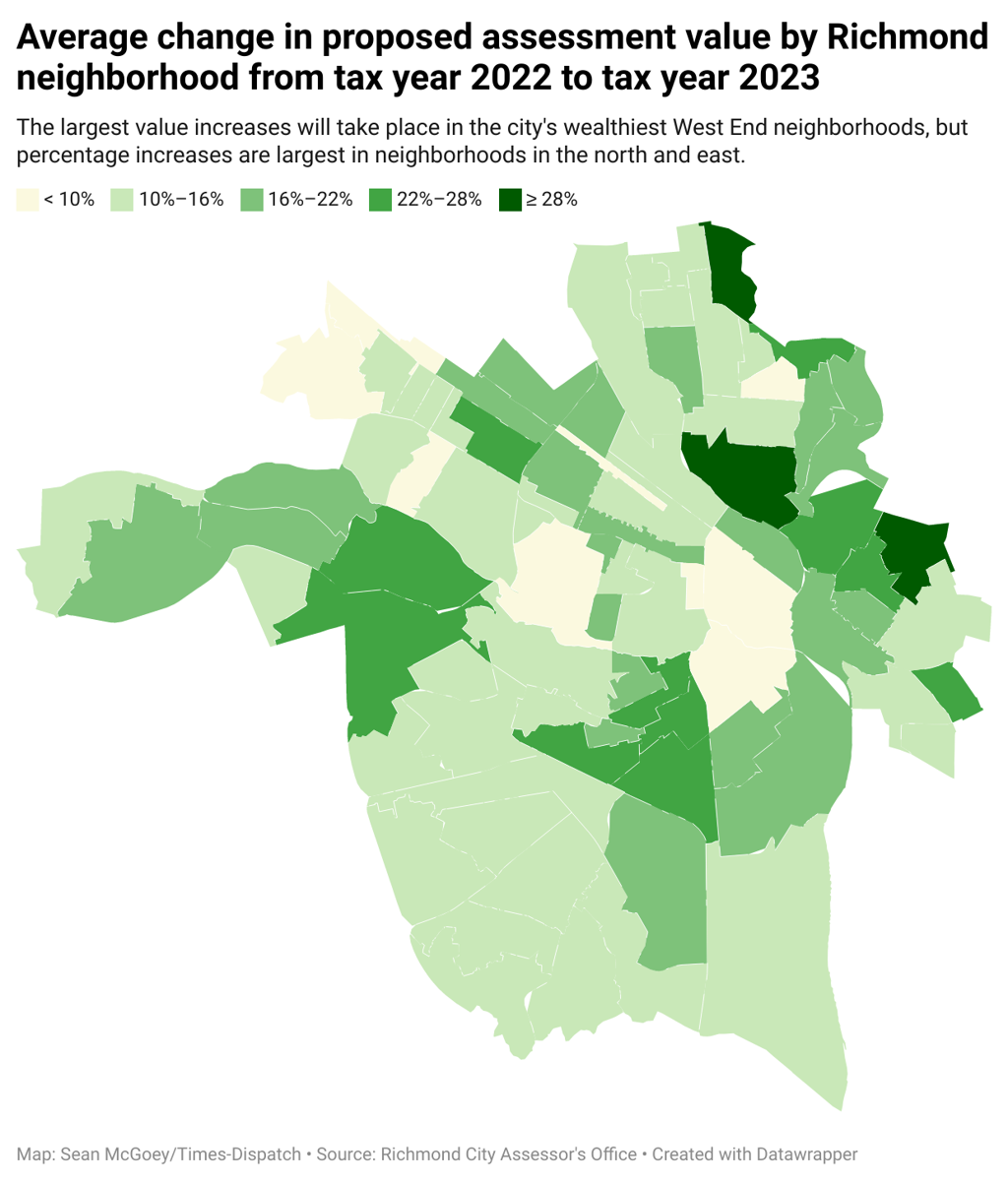

Where Richmond Property Values Went Up Most Axios Richmond

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Virginia Property Tax Calculator Smartasset

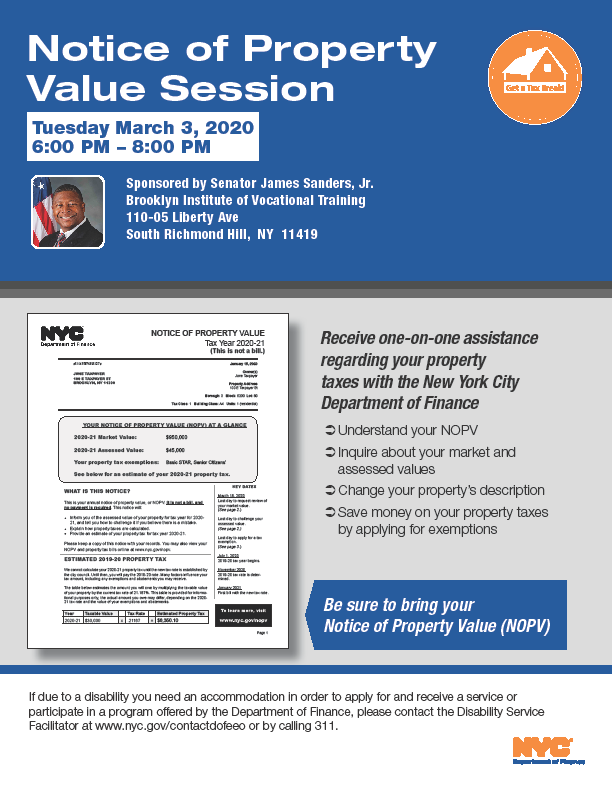

Sanders To Host Property Value Session Property Tax Assistance Ny State Senate

City Of Richmond Va Cityrichmondva Twitter

For Sale 3724 Fm 359 Road Richmond Tx 77406 6 Beds 3 Full Baths 5 960 000